Alpha-1-antitrypsin disease (AATD) is caused by mutations in the SERPINA1 gene coding for alpha-1-antitrypsin (AAT). There are an estimated 100000 alpha-1 patients in the US alone, making it a rare, but not ultra-rare disease.

Correcting these mutations, replacing AAT through gene

therapy, or inhibiting the particularly pathogenic Z-allele is subject to the

efforts of a number of nucleic acid-based drug developers, most notably Arrowhead

Pharmaceuticals (RNAi), Wave Life Sciences and Korro Bio (RNA

Editing) as well as CRISPR genome editing companies Beam Therapeutics

(Base Editing) and Intellia Therapeutics (CRISPR Cas9 and targeted gene

insertion).

The protein name is somewhat misleading as it’s main function is to antagonize neutrophil elastase activity in the lung. Insufficient AAT activity can lead to lung injury during pulmonary stress, especially respiratory infections or smoking. Historically, lung disease has been addressed by smoking cessation and preventing lung infection (e.g. through vaccination).

In those patients that do progress to symptomatic lung

disease, the standard of care still remains weekly infusions with

plasma-derived (!) alpha-1-antitrypsin.

Although the evidence of benefit is substandard, partly the result of having a ‘good-enough’

therapy approved decades ago on simple biochemical measures, this

is now a $1B+ market and growing with the increased identification of this

genetic form of chronic obstructive pulmonary disease (COPD). Growing awareness of the liver aspect of the genetic condition also contributes to better patient identification.

Achieving 50-60% of normal AAT activity is expected to

be therapeutic based on human genetics.

As lung health and longevity has been improving in

alpha-1, it is estimated that 15% of adult patients develop the serious

condition of liver cirrhosis. There is also an infant form AAT liver disease manifesting in ~10% with alpha-1 mutations that can result in cirrhosis and the need for liver transplantation. Although this is less well understood than the adult form, it is likely to involve excessive accumulation of alpha-1-antitrypsin in the liver. These patients typically carry the Z allele on both chromosomes (piZZ). This allele is particularly prevalent among the European and US AATD populations

(~90% of 235k worldwide). As true AAT

null mutations are rare, piZZ is by far the most prevalent genotype of patients

presenting with either lung or liver disease.

The Z alpha-1 antitrypsin variant protein misfolds,

aggregates and gets stuck in the endoplasmic reticulum of the liver. This results in

liver inflammation and progressive injury (cirrhosis, hepatocellular carcinoma/HCC). A small fraction (10-15%) of Z-AAT does get

exported, but even if it makes it to the lung it is less functional and may even

exacerbate lung inflammation due to its propensity to precipitate.

Removing Z-AAT is expected to halt and even reverse

liver disease based on human genetics (1 Z allele not sufficient to cause

disease) and preclinical animal models.

Here I will discuss some of the more promising, new innovative approaches utilizing a number of nucleic acid therapeutics modalities to address the lung and/or liver complications of AATD. It also explains the following rank order of the approaches in terms of promise for AAT lung and liver disease.

1. RNAi for A1AT-related liver

disease (Arrowhead Pharmaceuticals and Takeda)

While innovation in the lung space of AATD has stalled, the disease attracted fresh attention in the pharmaceutical industry about a decade ago for its

liver-related complications as (piZZ) alpha-1 patients get older and increasingly

suffer from liver failure and HCC. This time also saw the rise of new therapeutic modalities such as RNAi.

The RNAi Therapeutic ARO-AAT by Arrowhead Pharmaceuticals has demonstrated almost complete elimination of the highly expressed gene in phase I

and II clinical trials. In preclinical

models, this has been shown to reduce existing liver Z-AAT aggregates and

inflammation over time.

In a small (n=25), 2:1 ARO-AAT/placebo randomized phase

II study in Z-AAT patients with liver fibrosis, there was a robust -68%

reduction in liver AAT globule burden. At 52

weeks, this translated to 50% of subjects on ARO-AAT having a 1 or more point improvement

in Metavir fibrosis (scale: 0/no fibrosis to 4/cirrhosis). Due to the small study size and the 3/8

responses (38%) in the placebo group, this did not reach statistical significance. Another small open-label study demonstrated a

similar 50% fibrosis response.

Importantly, RNAi knockdown of Z-AAT did not worsen pulmonary health over 1 year in the controlled (no smoking etc) trial setting. This may be partly due to Z-AAT being functionally impaired anyway and may do more harm than good in the lung.

A longer 2 year 160 patient pivotal phase 3 study with F2-4

disease is underway to statistically confirm the benefit of

ARO-AAT (aka TAK-999) on liver fibrosis (in F2+3 patients). Results from that study can be expected in

early 2026.

2 years should be plenty of time for liver globules to

turn over. And as the liver is good in

regenerating once you take the fibrogenic trigger away (see HCV, NASH etc)- as long as the liver is not in a late-stage cirrhotic stage already- this should translate into a fibrosis benefit.

For AAT liver disease, Arrowhead enjoys at least a 5 year headstart over the non-RNAi competition which has yet to enter the clinic. Dicerna, now a Novo Nordisk company, has also been developing an RNAi trigger (belcesiran) for AAT which is in a phase II and has demonstrated -77% knockdown following a single dose.

In terms of efficacy, Arrowhead’s RNAi approach with it’s almost complete elimination of AAT in the liver appears to be substantially superior over the competition with non-RNAi approaches struggling to get to -70-75% Z-AAT reductions. This assumes that more knockdown is correlated with efficacy or at least the time for efficacy to manifest. Based on human genetics, the equivalent of life-long treatment, where subjects with just one Z allele have not much added risk of developing liver disease, this may not be necessary.

2. CRISPR Cas9 for Liver Disease

The non-RNAi approach in development for AAT liver disease that is likely the next most efficacious one is CRISPR Cas9 DNA cleavage as developed by Intellia Therapeutics. Intellia has already demonstrated 90%-type gene knockout efficiencies in hepatocytes for TTR amyloidosis and hereditary angioedema in the clinic, so expectations are for similar target engagement in the AAT program. Cas9-targeted DNA cleavage is certainly a powerful tool to downregulate gene expression.

The question, however, is whether you would want to

risk disabling a gene permanently when you have non-permanent alternatives like

RNAi that are at least equally efficacious.

Similar to transthyretin in TTR amyloidosis, alpha-1-antitrypsin is a highly

expressed gene in the liver that has important functions in human biology and

health. TTR for example is a carrier of thyroxin

and retinol binding protein (à

vitamin A) while AAT is involved in the homeostasis of protease activity for

example during infection in the lung and probably has similar homeostatic functions in other tissues.

Side effects from the long-term ablation of AAT may only

manifest after years and may then require life-long supplementation (vitamin A, thyroxin), or after certain stress situations (non-genetic COPD etc). To my

knowledge, unlike for say PCSK9, human genetics does not support that lifelong

absence of AAT is ideal. Similarly,

regulatory agencies will be worried about cancer resulting

from genome re-arrangements rearing their ugly heads 10 years or so down the

line following on- or off-target DNA cleavage in and outside liver cells

(including germline).

In my opinion, unless genome editing can demonstrate

clear efficacy advantages over otherwise quite safe and non-onerous, non-permanent alternatives, it is only with the accumulation of long-term safety data that we will be able to tell whether CRISPR Cas9 can be used more broadly.

3. RNA Editing for Lung and Liver Disease (Wave Life Sciences, Korro Bio)

When it comes to addressing AATD lung disease, my

favorite approach is via RNA Editing with an exciting candidate by Wave Life Sciences

(WVE-001) about to enter the clinic.

Korro Bio aims to enter a competing RNA Editing candidate into the

clinic in late 2024.

However, Korro Bio candidate would likely have to be relatively

frequently (weekly) administered via intravenous infusion and has no obvious

efficacy advantage over WVE-001 and LNP-related toxicities to be expected

(infusion reactions, triggering of innate immunity etc). As a second mover

with an inferior therapeutic profile, I am struggling to understand Korro Bio’s

business rationale here (also discussed here).

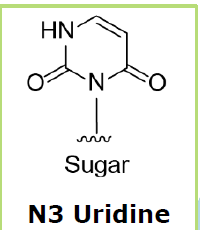

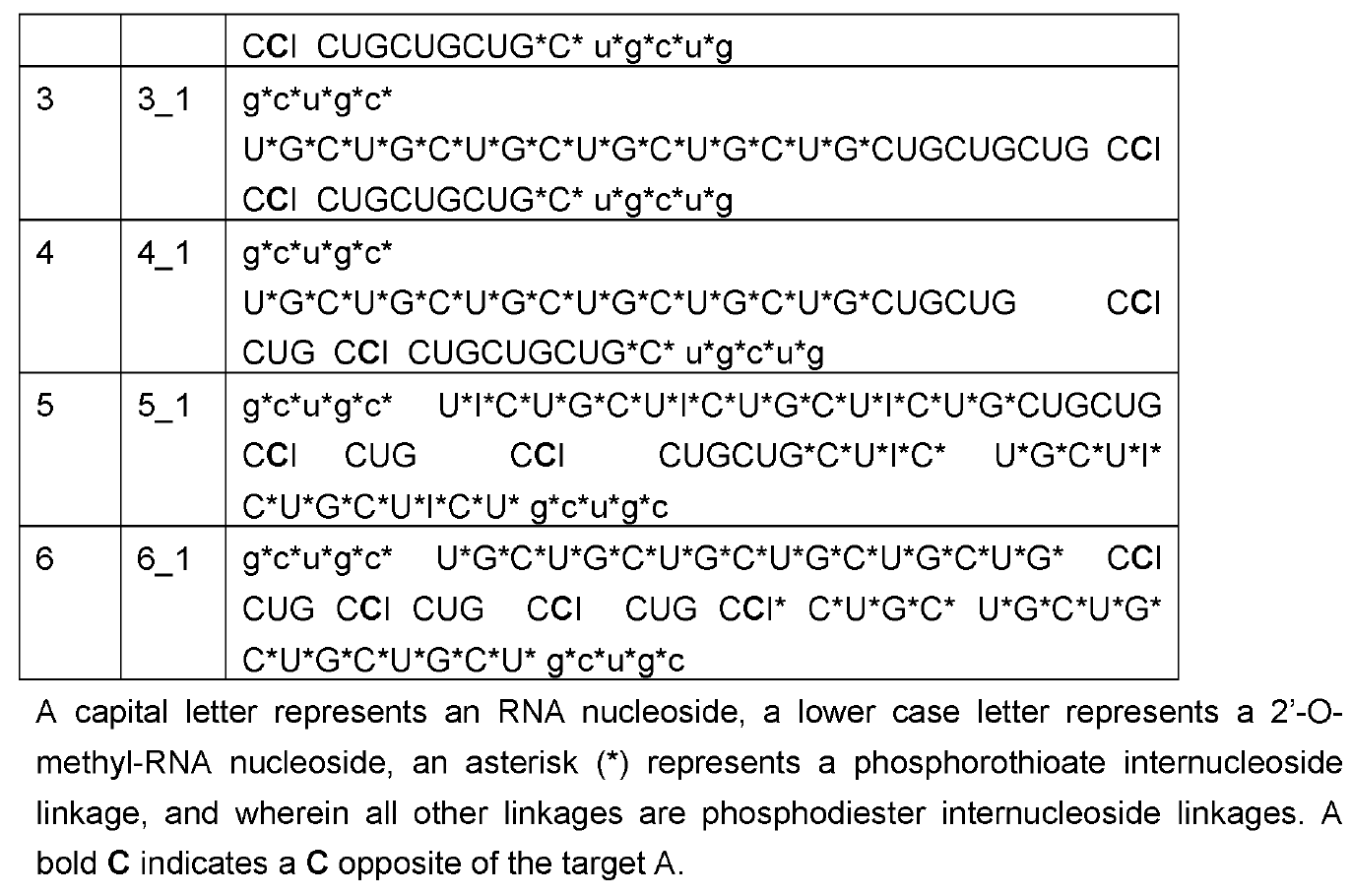

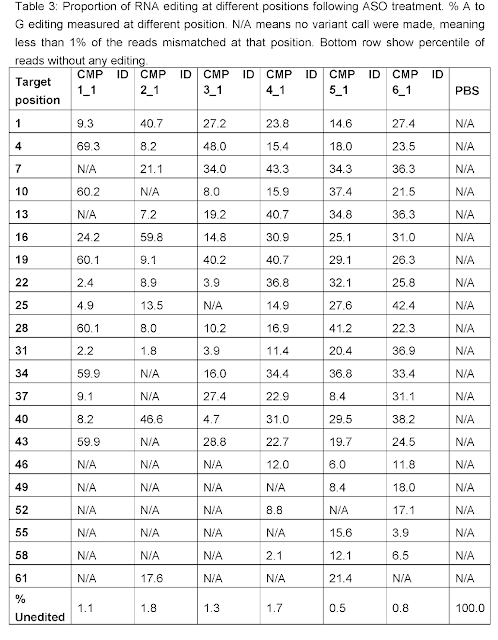

As discussed on this blog, RNA Editing in AATD aims to

convert the pathogenic piZ allele into the healthy M allele. Based on human genetics where MZ carriers are

protected from both liver and lung disease, a 50% AàI editing rate may suffice for both indications. Wave Life Sciences has been able to meet that bar in preclinical

studies. Given the newness of RNA

Editing, results from the first clinical study for this modality utilizing

Wave’s subcutaneously administered oligonucleotide chemistry will still have to show

just how efficacious and sustained (in terms of dosing frequency) their approach

will prove to be in humans.

A significant uncertainty is how long it will take for even robust >60% editing to translate into actual clinical benefit. Unlike for the liver where the natural

turnover of pathogenic globules will likely be rate-limiting for liver health

improvement to manifest, generating healthy, wild-type alpha-1-antitrypsin

should be immediately beneficial to the lung.

Identifying a patient population with still relatively healthy lungs but

rapid functional decline should therefore be most promising for a clinical

trial.

For this, Wave Life Science has

recruited pulmonary disease powerhouse GSK through a out-licensing as setting a

new standard of care will not be as easy as simply demonstrating AAT blood

biomarker as the incumbents had gotten away with. The fact that plasma-derived

products from the stone age of biotechnology still dominate what today has

grown into a blockbuster market shows how difficult it has been to find new

therapeutic strategies worth investing in. As the plasma-derived

products have been unable to demonstrate a clear therapeutic benefit in

controlled studies, this would likely involve running a relatively large and

long-term clinical study being very mindful of stratifying the diverse patient

population.

The reason why RNA Editing could represent a meaningful improvement to

the standard of care in AAT lung disease is that it promises to offer more

sustained, tonic amounts of AAT instead of the spiked pharmacokinetics from

weekly infused AAT. Moreover, because RNA Editing converts mutant to wild-type

AAT that is transcribed from the native gene under physiological controls (e.g.

promoter activity), adverse effects from supraphysiological levels of AAT

should not be observed.

Wave Life Sciences claims that RNA Editing can not only address lung AATD,

but also its liver manifestations. To find out, GSK would have to

run a separate study and hope that clinical success is not linear with Z-AAT

reduction. Because if this were the case, RNAi would likely win out over RNA

Editing not only in terms of knockdown efficacy, but also dosing

frequency. There is some preclinical evidence, however, that

wildtype AAT may aid cellular export of Z-AAT, so a 50% mRNA conversion may

reduce intracellular Z-AAT more than 50%. Possibly worth a competitive

gamble.

4.

Base Editing for Lung and Liver

Disease (Beam Therapeutics)

Similar to Wave Life Sciences, Beam Therapeutics aims to correct the

piZZ mutation, but this time applying CRISPR genome base editing for permanent correction. Unlike

traditional CRISPR Cas9, Beam’s CRISPR proteins are unable to make

double-strand. Instead, a base-editing enzyme is tethered to the Cas protein

which is guided to the target location by the guide RNA. In this

case, the base editor is an Adenine Base Editor converting proximal adenines

into guanine.

Unlike RNA Editing where you can precisely determine the editing site

through secondary fit and oligonucleotide modifications with essentially no

off-target editing, tethered base editors will act on what is close

by. Most problematic for the Beam program appears to be a bystander adenine

that is 2 bases away from the targeted adenine such that for each desired

single edit you seem to get equal amounts of double-edited AAT mRNAs resulting

in alpha-1 antitrypsin that is significantly less functional.

This also raises that question on how many more unidentified off-target

base edits there are. The genome in the nucleus is not linear, but

dynamic with tertiary interactions between chromosomes, within a chromosome and

transcriptional hubs bringing multiple genes into close vicinity. So

imagine a crowded nucleus with thousands of CRISPR-tethered base editors

floating around looking for adenine substrates. It will sure be

interesting how regulatory agencies around the world will be looking at this as

well as the risk of germline editing following LNP delivery.

Base editing efficiencies are slightly less than RNA Editing in

preclinical models with the added caveat around the double edits.

Beam intends to file for clinical trial applications in Q1

2024.

5.

Integrational Gene Therapy for Lung

Disease (Intellia Therapeutics)

Finally, in addition to gene demolition using Cas9 for liver disease,

Intellia is advancing a separate CRISPR-mediated gene insertional approach for

AAT lung disease. Here, an LNP delivers Cas9 mRNA-gRNA to open up

DNA downstream of the albumin promoter, highly active in

hepatocytes. An AAV carrying AAT cDNA gets administered alongside so

that a certain fraction gets incorporated as the DNA damage repair machinery

attempts to mend the lesion.

Preclinical non-human primate data support that marked expression can

thus be achieved as the albumin promoter now drives transcription of AAT-cDNA. It

is noteworthy that albumin drop-in has gone a bit out of fashion in the genome

editing field after Sangamo Biosciences had similarly claimed high preclinical

expression for hemophilia and lysosomal storage disease almost a decade ago.

Strangely, as so often has been the case with Sangamo, this could not be

reproduced at all in the clinic (barely detectable levels if

any at all). Intellia is using a curious inverted repeat design as

their drop-in cassette and believes this to be a game-changer in the

approach. They may have done this to double their chances that the

insertion happens in the correct orientation, but as a former molecular

biologist trained in RNA polymerase II transcription and RNAi this looks like

inviting trouble to me.

In any case, a surprising pivot by Intellia for AAT lung disease and we

will have to see how this approach can thread the needle of achieving

substantial, but not exaggerated amounts of AAT….over the long-term…and with

little interpatient variability.

Intellia intends to submit a clinical trial application for NTLA-3001 by

year-end.